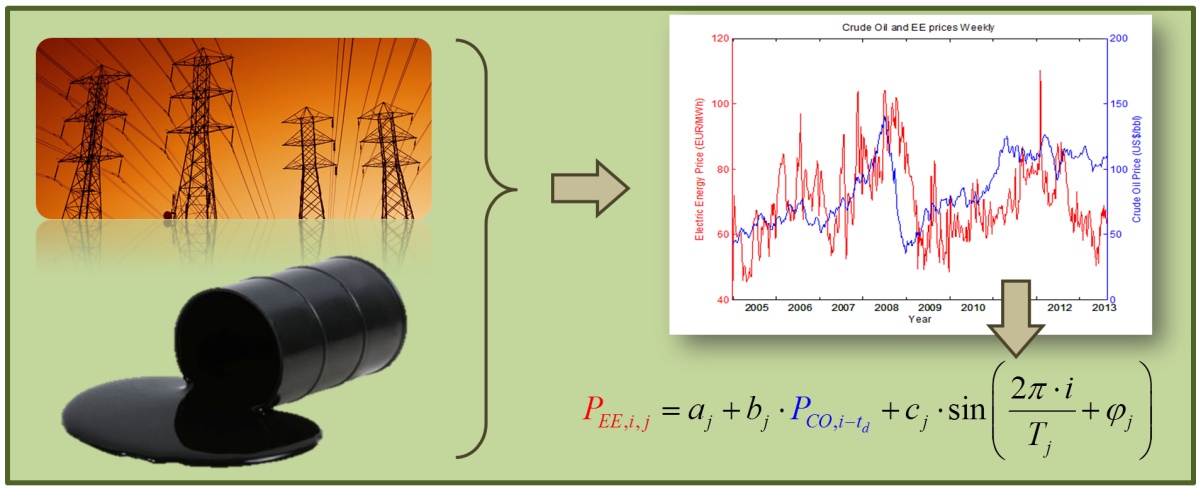

PSE-Lab has just published a new paper on “Computers and Chemical Engineering” titled:

Price model of electrical energy for PSE applications

by Davide Manca

Abstract

The Electrical Energy (EE) price plays a significant role in the economic assessment of industrial processes. PSE/CAPE applications are often based on economic evaluations/optimizations where EE price and its possible dynamic evolution are important input data. Planning, scheduling, on-line optimization, (dynamic) conceptual design, and feasibility studies are some of the applications where short-, medium-, and long-term predictions of EE quotations are involved. The paper discusses the main issues that contribute to EE quotations such as geographical, meteorological, seasonal, political, social, and financial terms. EE prices show a significant dependency on crude oil quotations with a time-delay of about a quarter/season. An econometric model comprising both linear and periodic components with an implicit stochastic term delivered by the reference component is first commented, then identified, and finally validated respect to real EE quotations. The paper provides also a discussion on how to forecast EE prices ranging from short- to long-term horizons.

Highlights

·        Analysis of electrical energy (EE) prices according to market quotations

·        Role played by the deterministic and stochastic terms on the EE model

·        Functional dependency of EE price from a reference component, i.e. crude oil

·        Tables of model parameters and equation for EE price forecast

·        The EE price model can be used for short, medium, and long-term horizon predictions

Interested readers can download a free copy of the paper until November 14th, 2015.

To cite the paper, please use this reference:

Manca, D. PRICE MODEL OF ELECTRICAL ENERGY FOR PSE APPLICATIONS, Computers and Chemical Engineering, 84, 208-216, (2016).

http://dx.doi.org/10.1016/j.compchemeng.2015.08.013